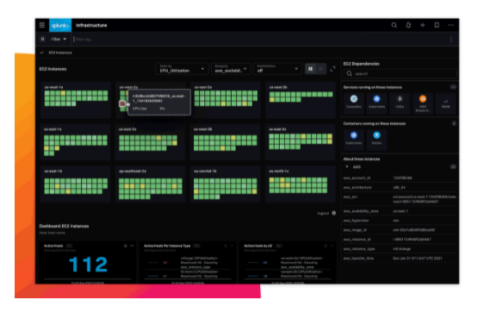

Splunk has announced several updates to its observability portfolio, spanning the products Splunk APM, Splunk RUM, Splunk Synthetic Monitoring, Splunk Log Observer, Splunk Infrastructure Monitoring, and Splunk IT Service Intelligence.

According to the company, these updates will help provide increased visibility, thus leading to improved performance, productivity, and innovation.

“Observability at its core is a data opportunity, and to use that data effectively organizations need a solution that can help ingest and analyze high-velocity data across increasingly dynamic environments and architectures,” said Spiros Xanthos, VP of product management of observability and IT operations at Splunk. “Our advanced observability capabilities bring monitoring into the modern era, empowering IT and DevOps teams to find, fix and prevent issues at any stage of their digital transformation journeys so they can deliver optimal user experiences.”

JumpCloud raises $225 million in Series F

This latest round brings the company’s total funding to over $400 million and its valuation to $2.625 billion. JumpCloud will use the funding to accelerate adoption of its directory platform across small and midsize enterprises.

“Across each of our customer bases, IT teams are looking for an alternative to Microsoft for managing and securing infrastructure. With this new investment, we can do deep integration work with both Atlassian and CrowdStrike to make JumpCloud’s open, cloud directory the obvious choice for all our customers,” said Rajat Bhargava, CEO of JumpCloud.

vFunction releases product updates, closes $26 million Series A

It released both vFunction Application Transformation Engine and pushed out an update to vFunction Modernization Platform. New capabilities will enable customers to assess, analyze, and manage the modernization process from end-to-end.

The company also announced that it closed a $26 million Series A funding round. The round was led by Zeev Ventures and Hewlett Packard Enterprise, with participation from existing investors Engineering Capital, Primera Capital, and Shasta Ventures. It will use the new funds to drive global expansion and respond to increased demand for app modernization initiatives.